Certified Public Accountant (CPA) vs. Enrolled Agent (EA)

How EA’s differ from CPA’s and why you’re in good hands

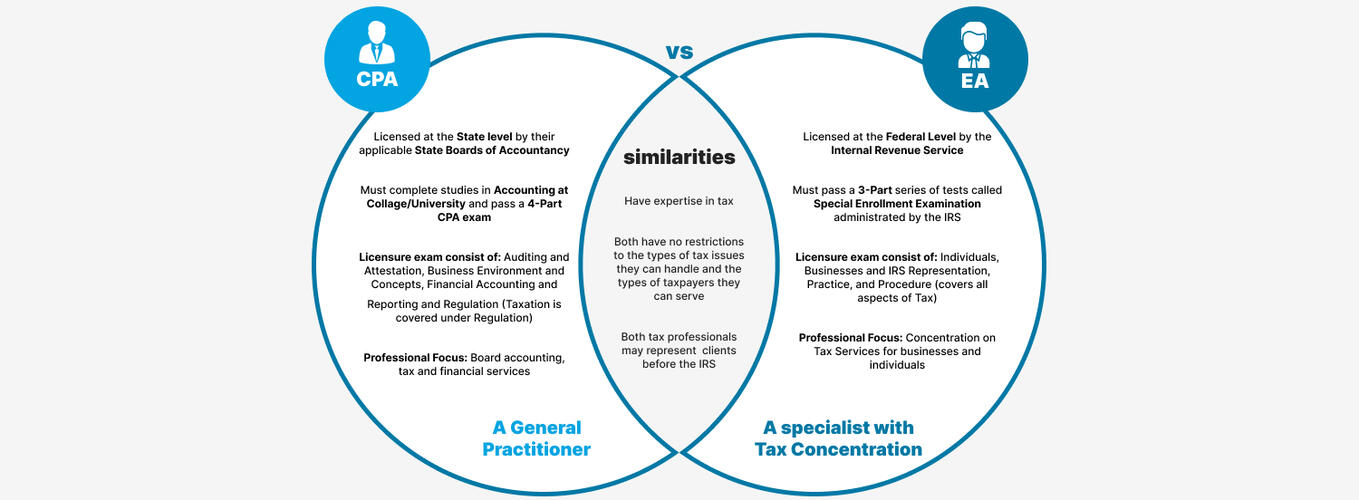

When it comes to tax preparation and representation, two of the most well-known professional designations are the Certified Public Accountant (CPA) and the Enrolled Agent (EA). The choice between the two can greatly impact the outcome of your case, as each offers different advantages and disadvantages.

To become a CPA, an individual must have a college degree, pass the Uniform CPA Exam, and meet specific experience and ethical requirements as set by their state board of accountancy.

CPAs are highly trained in a wide range of accounting and financial services, including tax planning and preparation, auditing, and financial statement preparation.

On the other hand, to become an EA, an individual must pass a comprehensive IRS exam or have sufficient experience working with the IRS. EAs are required to complete continuing education courses to maintain their license and have unlimited practice rights to represent clients before the IRS. According to the Journal of Accountancy:

"EAs are the only tax practitioners who receive their right to practice from the federal government rather than a state board."

One key difference between CPAs and EAs is that each state may have different regulations for CPAs, while EAs are governed by the IRS. For example, some states require CPAs to complete continuing education courses, while others have stricter ethical standards.

For example, some states require CPAs to complete continuing education courses, while others have stricter ethical standards. On the other hand, EAs must abide by the IRS's Office of Professional Responsibility standards and regulations. This gives EAs a unique advantage in representing clients on a national level, as they are well-versed in federal tax laws and regulations. This is especially beneficial for taxpayers who move or conduct business in multiple states.

"As a professional designation solely focused on taxation, EAs bring a deep understanding of the tax code and expertise to the table."

They can provide expert guidance and representation to individuals and businesses on a wide range of tax-related matters, from preparation and filing of tax returns to resolving tax disputes and negotiating payment plans. According to Forbes magazine:

"Enrolled agents are the tax experts of the tax preparation world, licensed by the federal government to represent taxpayers before the Internal Revenue Service (IRS)."

Their expertise and skills make EAs an attractive choice for law and accounting firms that want to provide their clients with the best possible tax preparation and representation services.

In conclusion, if you are looking for expert assistance with your tax-related matters, an Enrolled Agent may be the best choice for you. With their deep knowledge of tax law and unlimited representation rights, EAs can provide valuable support and guidance to ensure a positive outcome for your case. As Forbes magazine suggests,

As Forbes magazine suggests, "Enrolled agents are a valuable resource for taxpayers seeking expert tax advice and representation."